CBS News poll: Biden-Trump race tight in Michigan, Pennsylvania, Wisconsin

In Michigan, Wisconsin and Pennsylvania, both Biden and Trump elicit feelings of worry, anger and nostalgia, according to latest CBS News poll.

Watch CBS News

In Michigan, Wisconsin and Pennsylvania, both Biden and Trump elicit feelings of worry, anger and nostalgia, according to latest CBS News poll.

Hanna Siegel's uncle, U.S.-Israeli citizen Keith Siegel, was one of the hostages seen in a Hamas propaganda video Saturday.

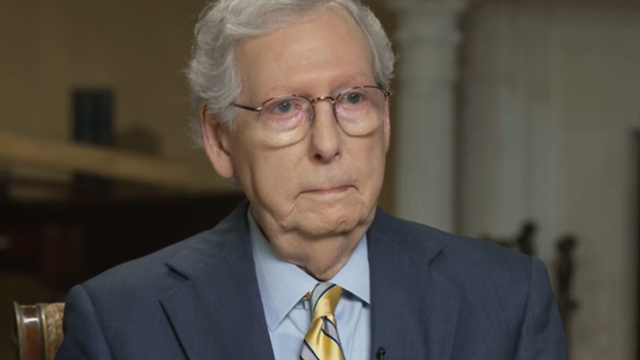

Senate Minority Leader Mitch McConnell, in an interview with "Face the Nation," weighed in on Trump's broad immunity claims.

It's been almost 20 years since Dan Rather signed off at the network where he spent 44 years covering wars, politics, and the assassination of JFK. But he has not retired from the life of a reporter.

Nonprofit organization World Central Kitchen is set to resume its aid work in Gaza, weeks after seven aid workers were killed.

More than 100 tornadoes were detected in six states in the Midwest over the weekend.

Pope Francis traveled to the lagoon city to visit the Holy See's pavilion at the Biennale contemporary art show and meet with the people who created it.

On Sunday, recreational boats will be able to pass through the Key Bridge collapse salvage during specific hours.

The Duke of Sussex will attend the thanksgiving service for the 10th anniversary of the Invictus Games Foundation in London on May 8.

Experts say there are rewards for not pushing yourself to the edge all the time.

She made a name for herself as an Oscar-nominated actress in "Almost Famous." But music has always been in her blood, and now Kate Hudson is making a name for herself as a singer-songwriter, with her debut album, "Glorious."

Campus protesters are "looking for some sort of acknowledgement from our leadership," Democratic Rep. Summer Lee of Pennsylvania said.

Author Erik Larson visits Fort Sumter in Charleston, S.C., where he discusses "the single most consequential day in American history."

2024 marks the 150th running of the Kentucky Derby at Louisville's Churchill Downs, the longest continuously-held sporting event in America.

Gabby Douglas qualified in multiple events for the U.S. Championships in Fort Worth, Texas, next month.

Regulators have closed Republic First Bank's 32 branches in Pennsylvania, New Jersey and New York and they will be taken over by Fulton Bank.

Bernhard Langer admitted that his injury came from playing pickleball.

Mr. Biden, like most of his predecessors, used the glitzy annual White House Correspondents' Association banquet to jab at his rival, former President Donald Trump.

Prosecutors in former President Donald Trump's criminal trial in New York called two new witnesses to the stand on Friday, rounding out the first week of testimony.

The court is considering whether Trump is entitled to broad immunity from criminal charges in the 2020 election case.

There are no cameras allowed in the court where he's being tried.

"I am happy to debate him," President Biden said during an interview with Howard Stern.

Trump has in the past railed against absentee voting, declaring that "once you have mail-in ballots, you have crooked elections."

President Biden finds familiar and active allies for his reelection bid with labor union endorsements.

The hostages seen on the video were identified as Omri Miran and Keith Siegel by the campaign group the Hostages and Missing Families Forum.

Hamas says it received the cease-fire proposal from Israel after a high-level Egyptian delegation wrapped up a visit to Israel.

Police are cracking down at some university protests over Israel's war against Hamas in Gaza.

Laura Kowal's match on an online dating site wasn't what he seemed. Now her daughter is on a mission to expose the risk of romance scams: "It could happen to anybody."

It's been a decade since the Flint water crisis began. Residents told CBS News the scandal still weighs heavily on the city.

For more than two decades, retired Lt. Gene Eyster wondered what became of that boy he found abandoned in a cardboard box in an apartment hallway.

Gold can be a smart bet for seniors — and that's not just due to the recent gold price uptick, either.

A HELOC can be a great borrowing option now, but the repayment process is unique. Here's what to know about it.

The average American is currently facing a hefty amount of credit card debt — but there are good ways to tackle it.

Intimacy coordination is a relatively new and growing field with movie and television productions required to make a good-faith effort to hire one if needed on set.

With a relatively low average monthly cost of living and a low crime rate, this little-known town has a lot to offer retirees according to one report.

Regulators have closed Republic First Bank's 32 branches in Pennsylvania, New Jersey and New York and they will be taken over by Fulton Bank.

The income needed to join your state's top earners can vary considerably, from a low of $329,620 annually in West Virginia to $719,253 in Washington D.C.

The union struck a four-year agreement with the German company on Friday evening, just before the expiration of the previous contract.

Pick up one of these rockers from AllModern, Wayfair, Serena & Lily and more for baby's nursery.

Here's how and when to watch the Würth 400 at Dover Motor Speedway NASCAR race.

Here's how and when to watch tonight's NBA Playoffs Game 4 between the Minnesota Timberwolves and Phoenix Suns.

Hosted by Jane Pauley. In our cover story, Susan Spencer looks at the importance of spending time being lazy. Plus: Lee Cowan sits down with news veteran Dan Rather; Tracy Smith talks with actress (and now singer-songwriter) Kate Hudson about her debut album, "Glorious"; Jim Axelrod looks at the history and pageantry of the Kentucky Derby, now in its 150th year; Anthony Mason joins author Erik Larson at Fort Sumter to explore the opening shots of the Civil War; David Pogue looks at unrest on America's college campuses; Alina Cho talks with artist Stanley Whitney about his first major retrospective, at age 78; and Conor Knighton visits a unique zoo for rescued animals, housed at a detention facility in Key West, Florida.

President Biden and former President Donald Trump are running even in a new CBS News poll of battleground states of Michigan, Pennsylvania and Wisconsin. CBS News director of elections and surveys Anthony Salvanto joins "Face the Nation" to discuss.

Hanna Siegel, the niece of U.S.-Israeli Keith Siegel, who is being held hostage by Hamas, tells "Face the Nation" that while the Biden administration has shown an "unwavering and relentless commitment to my family the families of all the hostages," she worries that "it's arguably not in Prime Minister Benjamin Netanyahu's political interest to close a deal."

Twenty-four years ago, Gene Eyster, then with the South Bend, Ind., police department, received a call about a newborn baby found abandoned in a cardboard box. For more than two decades, Eyster wondered what became of that boy. A few weeks ago, he found out, perhaps when he needed to most. Steve Hartman reports.

Social pressures to be productive – not to mention a culture that prizes multitasking – make doing nothing hard to do, for fear of being accused of the dreaded sin of laziness. However, experts say there are rewards for not pushing yourself to the edge all the time. Correspondent Susan Spencer looks at how some of the most productive and innovative people in history allowed themselves to take time out, just to be.

It's been almost 20 years since Dan Rather signed off as anchor and managing editor of the "CBS Evening News," at the network where he spent 44 years covering wars, politics, and the assassination of JFK – and where he mentored a young correspondent named Lee Cowan. Rather, now 92, talks with Cowan about his illustrious career; about the story that gave him (and CBS) a black eye; and his post-CBS years, writing books and finding a new, younger audience on social media.

Beginning on April 12, 1861, over the course of two days, more than 3,300 shells and cannon balls rained across Charleston Harbor towards Fort Sumter, the first shots fired in the Civil War. Correspondent Anthony Mason visits the fort with bestselling author Erik Larson, whose latest book, "The Demon of Unrest," explores the events leading up to the bombardment and what Larson calls "the single most consequential day in American history."

Kate Hudson made a name for herself as an Oscar-nominated actress in "Almost Famous." But music has always been in her blood, and now Hudson is making a name for herself as a singer-songwriter. She talks with correspondent Tracy Smith about her debut album, "Glorious," filled with her songs about life and love, and reveals the one song that truly rips her heart out.

2024 marks the 150th running of the Kentucky Derby, the longest continuously-held sporting event in America. Correspondent Jim Axelrod visits Churchill Downs to explore the history and spectacle of the "Run for the Roses."

She made a name for herself as an Oscar-nominated actress in "Almost Famous." But music has always been in her blood, and now Kate Hudson is making a name for herself as a singer-songwriter, with her debut album, "Glorious."

Kate Hudson made a name for herself as an Oscar-nominated actress in "Almost Famous." But music has always been in her blood, and now Hudson is making a name for herself as a singer-songwriter. She talks with correspondent Tracy Smith about her debut album, "Glorious," filled with her songs about life and love, and reveals the one song that truly rips her heart out.

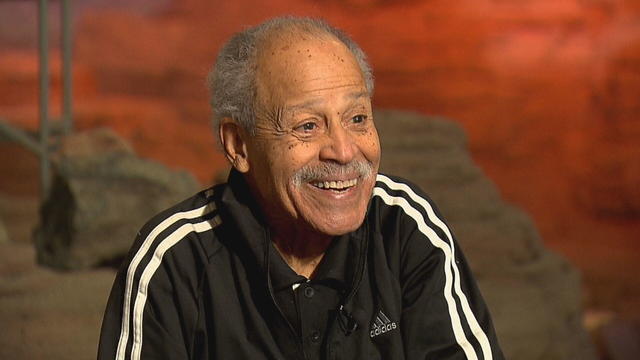

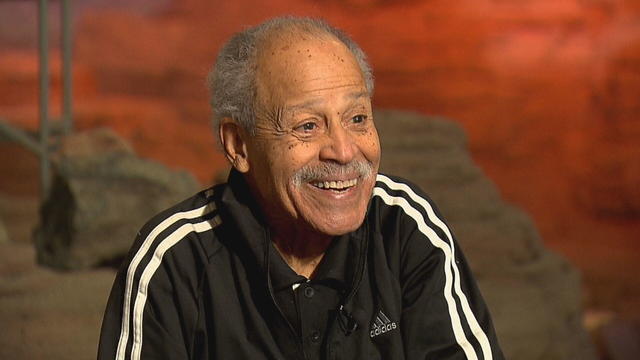

He's been painting for more than 50 years, but artist Stanley Whitney – whose bold, colorful canvases offer vibrant hues and deliberately ferocious brushstrokes – is just now getting his first major retrospective (including many works never before exhibited publicly), at the Buffalo AKG Art Museum in Buffalo, N.Y. Correspondent Alina Cho talks with Whitney about the breakthrough that came during his artistic journey.

Alexis Quaretti is the executive culinary director of Oceania Cruises and oversees more than 30 restaurants across the cruise line's fleet of ships. Michelle Miller has more.

Public baths have been the center of city life in Japan for centuries. But since 2006, hundreds of such baths have closed. Some are working to preserve the ancient tradition, which they say allows for socializing and relaxation.

Summer Lee, a Democrat from Pennsylvania who last week won a primary from a centrist challenger, tells "Face the Nation" that she recently visited pro-Palestinian protesters at a Pittsburgh campus, but "we don't" hear from these students if they are excited to vote for President Biden in November. But, she says, what she has mainly heard from protesters is that "they want to see a ceasefire in Gaza."

UNICEF executive director Catherine Russell tells "Face the Nation" that she recently visited the Israeli-occupied West Bank and saw firsthand the devastation from the uptick violence, while she also met with the Israeli families of those held hostage by Hamas. "I came back feeling like, there's just so much pain and misery everywhere you look," she said.

Amid protests at college campuses nationwide, University of Chicago political science professor Robert Pape, who is also the founding director of the Chicago Project on Security and Threats, tells "Face the Nation" that "there are so many reasons" university leaders should take "calming steps" now.

President Biden and former President Donald Trump are running even in a new CBS News poll of battleground states of Michigan, Pennsylvania and Wisconsin. CBS News director of elections and surveys Anthony Salvanto joins "Face the Nation" to discuss.

Israel's war on Hamas has a new frontline — campus protests and free speech battles at colleges in the U.S. Mark Strassmann reports.

A police officer becomes a guardian angel for a little girl struggling at school. A New Jersey toddler goes viral for the way she speaks, bringing joy and laughs to millions. A 7-year-old makes history at the rodeo. Plus, more inspiring stories.

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

A surfing accident left New York teacher Billy Keenan paralyzed, but when he received a call from a police officer, his life changed.

The So Much To Give Inclusive Cafe in Cedars, Pennsylvania employs 63 people — 80% have a disability.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

Pope Francis traveled to the lagoon city to visit the Holy See's pavilion at the Biennale contemporary art show and meet with the people who created it.

On this "Face the Nation" broadcast, Senate Minority Leader Mitch McConnell and UNICEF executive director Catherine Russell join Margaret Brennan.

The Duke of Sussex will attend the thanksgiving service for the 10th anniversary of the Invictus Games Foundation in London on May 8.

2024 marks the 150th running of the Kentucky Derby at Louisville's Churchill Downs, the longest continuously-held sporting event in America.

An official at the home of the Kentucky Derby calls an independent investigation into horse racing fatalities "a wake-up call for the industry," and talks of initiatives to better protect equines and humans at the track.

The union struck a four-year agreement with the German company on Friday evening, just before the expiration of the previous contract.

Intimacy coordination is a relatively new and growing field with movie and television productions required to make a good-faith effort to hire one if needed on set.

Under the new law signed this week, ByteDance has nine to 12 months to sell the platform to an American owner, or TikTok faces being banned in the U.S.

The income needed to join your state's top earners can vary considerably, from a low of $329,620 annually in West Virginia to $719,253 in Washington D.C.

About 7 in 10 retirees stop working before they turned 65. For many of them, it was for reasons beyond their control.

Campus protesters are "looking for some sort of acknowledgement from our leadership," Democratic Rep. Summer Lee of Pennsylvania said.

Hanna Siegel's uncle, U.S.-Israeli citizen Keith Siegel, was one of the hostages seen in a Hamas propaganda video Saturday.

On this "Face the Nation" broadcast, Senate Minority Leader Mitch McConnell and UNICEF executive director Catherine Russell join Margaret Brennan.

The following is a transcript of an interview with UNICEF executive director Catherine Russell that aired on April 28, 2024.

The following is a transcript of an interview with Rep. Summer Lee, Democrat of Pennsylvania, that aired on April 28, 2024.

Around 1 in 5 retail milk samples had tested positive for the bird flu virus, but further tests show it was not infectious.

The White House had been due to decide on the menthol cigarette rule in March.

The discovery of drug-resistant bacteria in two dogs prompted a probe by the CDC and New Jersey health authorities.

First known HIV cases from a nonsterile injection for cosmetic reasons highlights the risk of unlicensed providers.

Are you using your smartwatch to the fullest? Here are 4 metrics doctors say can be useful to track beyond your daily step count.

Pope Francis traveled to the lagoon city to visit the Holy See's pavilion at the Biennale contemporary art show and meet with the people who created it.

The Duke of Sussex will attend the thanksgiving service for the 10th anniversary of the Invictus Games Foundation in London on May 8.

Nonprofit organization World Central Kitchen is set to resume its aid work in Gaza, weeks after seven aid workers were killed.

The hostages seen on the video were identified as Omri Miran and Keith Siegel by the campaign group the Hostages and Missing Families Forum.

Iraqi authorities are investigating the killing of a well-known social media influencer Um Fahad who was shot by an armed motorcyclist in front of her home in central Baghdad.

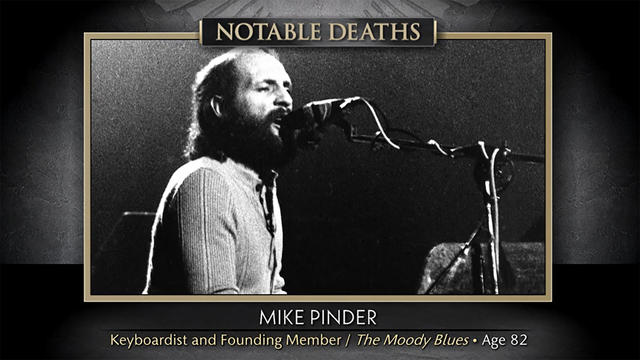

"Sunday Morning" remembers some of the notable figures who recently left us, including keyboardist Mike Pinder, of The Moody Blues.

She made a name for herself as an Oscar-nominated actress in "Almost Famous." But music has always been in her blood, and now Kate Hudson is making a name for herself as a singer-songwriter, with her debut album, "Glorious."

Kate Hudson made a name for herself as an Oscar-nominated actress in "Almost Famous." But music has always been in her blood, and now Hudson is making a name for herself as a singer-songwriter. She talks with correspondent Tracy Smith about her debut album, "Glorious," filled with her songs about life and love, and reveals the one song that truly rips her heart out.

He's been painting for more than 50 years, but artist Stanley Whitney – whose bold, colorful canvases offer vibrant hues and deliberately ferocious brushstrokes – is just now getting his first major retrospective (including many works never before exhibited publicly), at the Buffalo AKG Art Museum in Buffalo, N.Y. Correspondent Alina Cho talks with Whitney about the breakthrough that came during his artistic journey.

This month's fiction and non-fiction titles include the follow-up from Amor Towles, author of the international sensation, "A Gentleman in Moscow."

NYU Langone Health and Meta have developed a new type of MRI that dramatically reduces the time needed to complete scans through artificial intelligence. CBS News correspondent Anne-Marie Green reports.

The Federal Communications Commission voted to adopt net neutrality regulations, a reversal from the policy adopted during former President Donald Trump's administration. Christopher Sprigman, a professor at the New York University School of Law, joins CBS News with more on the vote.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

Are you using your smartwatch to the fullest? Here are 4 metrics doctors say can be useful to track beyond your daily step count.

Local and federal authorities face challenges in investigating and prosecuting romance scammers because the scammers are often based overseas. Jim Axelrod explains.

Bats have often been called scary and spooky but experts say they play an important role in our daily lives. CBS News' Danya Bacchus explains why the mammals are so vital to our ecosystem and the threats they're facing.

Pediatrician Dr. Mona Hanna-Attisha, whose work has spurred official action on the Flint water crisis, told CBS News that it's stunning that "we continue to use the bodies of our kids as detectors of environmental contamination." She discusses ways to support victims of the water crisis, the ongoing work of replacing the city's pipes and more in this extended interview.

Ten years ago, a water crisis began when Flint, Michigan, switched to the Flint River for its municipal water supply. The more corrosive water was not treated properly, allowing lead from pipes to leach into many homes. CBS News correspondent Ash-har Quraishi spoke with residents about what the past decade has been like.

According to the University of California, Davis, residential energy use is responsible for 20% of total greenhouse gas emissions in the U.S. However, one company is helping residential buildings reduce their impact and putting carbon to use. CBS News' Bradley Blackburn shows how the process works.

Emerging cicadas are so loud in one South Carolina county that residents are calling the sheriff's office asking why they can hear a "noise in the air that sounds like a siren, or a whine, or a roar." CBS News' John Dickerson has details.

After a traditional autopsy, a coroner ruled Kristen Trickle died by suicide. But prosecutors in Kansas questioned if she could have fired the large-caliber revolver that killed her and ordered an autopsy of her mind.

Viktoria Nasyrova attempted to murder a woman with cheesecake. As one private investigator would find out, she had a list of alleged victims — including her ex-boyfriend's dog.

Angel Gabriel Cuz-Choc was found hiding in a wooded area after his girlfriend and her 4-year-old daughter were found dead in Florida.

Dramatic bodycam footage shows the moment Florida deputies and K-9 dogs close in on a double murder suspect hiding in a thickly wooded area.

A new "48 Hours" investigation is looking into the death of a Kansas woman after she was found dying from a gunshot wound in 2019. The coroner initially ruled Kristen Trickle's death a suicide, but the local prosecutor said evidence on the scene didn't add up. "48 Hours" correspondent Erin Moriarty has the story.

Astronauts Barry Wilmore and Sunita Williams say they have complete confidence in the Starliner despite questions about Boeing's safety culture.

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

The creepy patterns were observed by the European Space Agency's ExoMars Trace Gas Orbiter.

The Shenzhou 18 crew will replace three taikonauts aboard the Chinese space station who are wrapping up a six-month stay.

In November 2023, NASA's Voyager 1 spacecraft stopped sending "readable science and engineering data."

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

Summer Lee, a Democrat from Pennsylvania who last week won a primary from a centrist challenger, tells "Face the Nation" that she recently visited pro-Palestinian protesters at a Pittsburgh campus, but "we don't" hear from these students if they are excited to vote for President Biden in November. But, she says, what she has mainly heard from protesters is that "they want to see a ceasefire in Gaza."

UNICEF executive director Catherine Russell tells "Face the Nation" that she recently visited the Israeli-occupied West Bank and saw firsthand the devastation from the uptick violence, while she also met with the Israeli families of those held hostage by Hamas. "I came back feeling like, there's just so much pain and misery everywhere you look," she said.

Amid protests at college campuses nationwide, University of Chicago political science professor Robert Pape, who is also the founding director of the Chicago Project on Security and Threats, tells "Face the Nation" that "there are so many reasons" university leaders should take "calming steps" now.

President Biden and former President Donald Trump are running even in a new CBS News poll of battleground states of Michigan, Pennsylvania and Wisconsin. CBS News director of elections and surveys Anthony Salvanto joins "Face the Nation" to discuss.

Israel's war on Hamas has a new frontline — campus protests and free speech battles at colleges in the U.S. Mark Strassmann reports.